Cunningham Warehouse Sales

Court Ordered Dissolution Of Buffalo Niagara Chauffeured Services, Inc. “Buffalo Limousine” A Well Established Limousine Company Grossing Almost $3 Million/Year! Assets (Sold As An Ongoing Operation) To Include: Seller Financing With 25% Down at 7% For 10 Years (3 Yr. Call) Sold Turn-Key – Equipment Included! Freestanding 4,040 Sq. Ft. Building **Some Equipment Only 4 Years Old!** **For Sale**2 Bedroom / 2 Bath Single Family Home with Tons of Updates Granite Countertops, Stainless Steel Appliances, Fireplace, Covered Patio & More Owner is Open to All Offers Husband, father, musician, writer, student, & lover of travel & vintage clothing! 6 Photos and videos Are you sure you want to view these Tweets? Viewing Tweets won't unblock @MontroseC. Loading seems to be taking a while. Twitter may be over capacity or experiencing a momentary hiccup. Try again or visit Twitter Status for more information. Add a location to your Tweets

When you tweet with a location, Twitter stores that location. You can switch location on/off before each Tweet and always have the option to delete your location history. Turn location onNot nowAnyone can follow this listOnly you can access this list The URL of this tweet is below. Copy it to easily share with friends. Add this Tweet to your website by copying the code below.

Boxer Breeders St Louis Mo Add this video to your website by copying the code below.

Oil Rubbed Bronze Free Standing Tub FaucetsSign up, tune into the things you care about, and get updates as they happen.

Gears Of War T-Shirt India Vodafone, Orange, 3, O2 Bharti Airtel, Videocon, Reliance AXIS, 3, Telkomsel, Indosat, XL Axiata

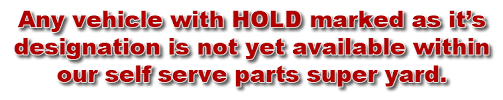

» See SMS short codes for other countriesPublic Notices Search - Palm Beach County If you wish to place a public notice click here or contact To register for legal notice alerts click here. U Pull It Used Auto Parts Pick-N-Save has 45+ acres of u pull it used auto parts. We offer our customers the ability to locate and pull their own automotive parts in effort to keep the their vehicle repair cost down to a fraction of buying new parts. Our customers can actually save between 50-80% over purchasing new parts. We are able to share this discount with our customers because they are the ones actually doing the labor. Pick-N-Save offers a computer generated report showing where each available car or truck is setting in an attempt to help you locate your part(s) quicker. Our goal is to help you find your part(s) so you can get your vehicle back on the road. If you are not able to find your part(s) at any of our facilities, Pick-N-Save employees would be more than happy to locate the part(s) within our network of over 100 recyclers throughout the country (Team PRP).

Simply see a cashier and they will locate the parts for you and have them shipped straight to your business or home address. If your vehicle is beyond repair or the cost of repairing the vehicle is too high, Pick-N-Save would be happy to buy your vehicle. Just fill the form and one of employees will give you a call. NOW OPEN – View Inventory Latest Inventory Arrivals2008 FORD FOCUS - September 8th 20162007 FORD FORD F150 PICKUP - September 8th 20162007 FORD FORD F150 PICKUP - September 8th 20162007 FORD FORD F150 PICKUP - September 8th 20162006 FORD FORD F150 PICKUP - September 8th 20162005 FORD FORD F150 PICKUP - September 8th 20162003 PONTIAC VIBE - September 7th 20162002 FORD EXPLORER - September 7th 20162000 FORD SABLE - September 7th 20161998 FORD SABLE - September 7th 20161996 HONDA CIVIC - September 7th 20161995 NISSAN 200SX - September 7th 20161995 HONDA CIVIC - September 7th 20161999 CHEVROLET CAVALIER (Images Pending)1991 BUICK LESABRE (Images Pending)1984 CHEVROLET S10/S15/SONOMA - September 2nd 20162002 FORD TAURUS (Images Pending)2004 ISUZU ISUZU RODEO - August 31st 20161999 DODGE DODGE 3500 VAN - August 31st 20161996 FORD EXPLORER - August 31st 20161993 PLYMOUTH SUNDANCE (Images Pending)2005 CHEVROLET COLORADO (Images Pending)2002 PONTIAC MONTANA - August 30th 20161996 FORD RANGER - August 30th 20162008 CHEVROLET COBALT - August 29th 20162007 HONDA ACCORD - August 29th 20162007 MITSUBISHI GALANT - August 29th 20162006 DODGE CARAVAN - August 29th 20162006 CADILLAC DTS -

August 29th 20162006 JEEP GRAND CHEROKEE - August 29th 2016 CCIM Learn More About CCIM Event Blogging Houston real estatewith Nancy Sarnoff All information provided is deemed reliable but is not guaranteed and should be independently verified. President, Chief Executive Officer & Chairman Tom Millon founded Capital Markets Cooperative (“CMC”) in 2003. Mr. Millon is one of the nation's top executives in the mortgage capital markets. He is a recognized author, frequent speaker, and expert in mortgage finance. He serves as President, Chief Executive Officer, and Chairman of CMC, and is the Chief Executive Officer and Chairman and of CMC’s lending subsidiary, CMC Funding, Inc. Mr. Millon has been instrumental in the development and growth of a number of companies within the mortgage industry. From 1999 to 2003, Mr. Millon was the Director of Capital Markets for Ohio Mortgage Banking, one of the top ten wholesale mortgage bankers in the U.S. Mr. Millon built an industry-leading capital markets group at Ohio Mortgage Banking, where the company’s origination volume quintupled to $30 billion during his tenure.

From 1991 to 1999, Mr. Millon was a Partner, Managing Director and Member of the Board of Directors of Tuttle & Company, a leading risk management and securities trading firm. The firm specialized in managing optional interest rate risk for mortgage bankers. Mr. Millon helped build the firm from five employees and a handful of clients to over 100 employees and a client base consisting of many of the largest banking institutions in the U.S. Just prior to the firm’s sale in 1999, Mr. Millon’s trading desk managed over 10% of the U.S. mortgage industry’s origination volume. In 1999, the Microsoft Corporation acquired Tuttle & Co. Prior to 1991, Mr. Millon was a member and floor trader on the Chicago Board of Trade, and was an analyst with Merrill Lynch Capital Markets. Mr. Millon graduated from the Wharton School of Business of the University of Pennsylvania in May 1986. He holds the Chartered Financial Analyst (CFA) and Certified Mortgage Banker (CMB) designations. Mr. Millon is FINRA (Financial Industry Regulatory Authority) Series 3 licensed and a member of the Mortgage Bankers Association, the National Futures Association, the Association for Investment Management and Research, and the Security Analysts Society of San Francisco.

Executive Vice President, Sales & Marketing Jeff Harry is a leading industry expert with over 20 years' experience in secondary marketing hedging services and whole loan trading. Since 2005, Mr. Harry has served as the Executive Vice President of Capital Markets Cooperative, where he oversees sales and marketing for the firm. Mr. Harry is also a shareholder and managing board member of CMC. From 2000 to 2005, Mr. Harry served as Senior Vice President and National Sales Manager for the ABN-AMRO Mortgage Capital Markets Group. Mr. Harry also managed all of the whole loan distribution for ABN AMRO North America. From 1993 to 2000, Mr. Harry was a senior partner at Tuttle & Company, a leading risk management and securities trading firm. He worked at Bank of America Capital Markets as an associate from 1989 to 1991. Mr. Harry is a graduate of the University of Texas with a Bachelor of Science in Business Administration and has his MBA from the University of North Texas.

He is a member of the Mortgage Bankers Association and the National Futures Association. Kent Saari has over 25 years' experience in the U.S. Mortgage industry and is an expert in mortgage interest rate risk management, delivery optimization & mortgage pipeline and warehouse management. Prior to joining Capital Markets Cooperative, Mr. Saari was the Senior Vice President of Secondary Marketing for Waterfield Financial Corporation/Union Federal Savings Bank. As an industry entrepreneur, he co-founded McDash Analytics, a firm that provides information and analytical services to the mortgage industry, which was later purchased by Fidelity National Financial. Mr. Saari received his Bachelor of Business Administration in Economics and Masters in Business Administration from the University of Toledo. He is a member of the Mortgage Bankers Association. Kirstin McMullen has over 20 years financial management experience in the Commercial Real Estate and Mortgage industries. Mrs. McMullen is an expert in financial planning and monitoring to ensure the financial health of the organizations she has worked for.

Prior to joining Capital Markets Cooperative, Mrs. McMullen held similar positions including raising debt and equity, financial modeling and budgeting, overseeing production of audited financial statements, corporate governance and compliance reporting. Mrs. McMullen received her bachelor of accounting from the University of Technology, Sydney. She then obtained her CPA. She began her career with Australia’s leading commercial real estate company, Lend Lease, who relocated her as an expatriate to New York City in 1996. Chief Business Development Officer Bill Lisnerski has spent over 25 years in a variety of senior management positions in the mortgage industry. Bill joined Capital Markets Cooperative in October, 2010 as the Senior Vice President of Mortgage Operations and President of Capital Markets Acquisitions. His responsibilities include the strategic planning for acquiring mortgage and servicing assets and the build out of the Correspondent Platform including loan servicing acquisition, agency co-issue and GNMA security programs.

Prior to joining CMC, Bill was recruited by IBM Lender Business Process Services as Mortgage Fulfillment Executive launching the IBM mortgage services program. In 2006, Bill became the Director of Change Management and Process Re-Engineering for American Home Mortgage. He launched initiatives to centralize various loan processes with a focus on credit quality and effective controls for compliance, loan funding and investor delivery. Mr. Wood has 16 years of legal and regulatory experience, with 14 years focused on residential mortgage servicing and origination activities. Prior to joining CMC in 2014, Mr. Wood held the position of Chief Risk Officer for RoundPoint Financial Group, part of the Tavistock Group. In this role, Mr. Wood was responsible for regulatory compliance, internal audit, vendor management and training for RoundPoint’s mortgage servicing, origination and asset management business lines. In 2000, Mr. Wood began his career in the mortgage business with Ocwen Financial Corporation where he spent 11 years in a variety of positions and functions, including contract management, capital markets, default servicing, REO management, early intervention, optional product marketing and compliance.

Immediately preceding his time at Ocwen, Mr. Wood was a staff attorney with the Kentucky Court of Appeals. At CMC, Mr. Wood’s daily responsibilities entail overseeing the risk management program as well as the compliance and legal departments. Mr. Wood holds a Bachelor of Arts degree from the University of Louisville and a Juris Doctor from Louisiana State University Paul M. Hebert Law Center. Mr. Wood is a member of the Kentucky Bar Association. Mr. Mignerey is responsible for the design, development and implementation of the company’s infrastructure and core processing technologies, including overseeing all daily trading activity. Prior to CMC, he was an Assistant Vice President with EverBank Home Mortgage where he served in various positions in the servicing and loan production divisions. Mr. Mignerey graduated from Clemson University with a Bachelors of Science degree in Business, received a Masters in Business Administration from Jacksonville University and is a member of the Mortgage Bankers Association.